THE DETAILS

Boost your business AND lower your tax bill! Section 168 (k) and 179 accelerated depreciation. You can expense up to 100% of a NEW RAM Commercial Vehicle purchase on 2019 taxes!

*Must purchase by end of December to be eligible for 2019 tax benefits.

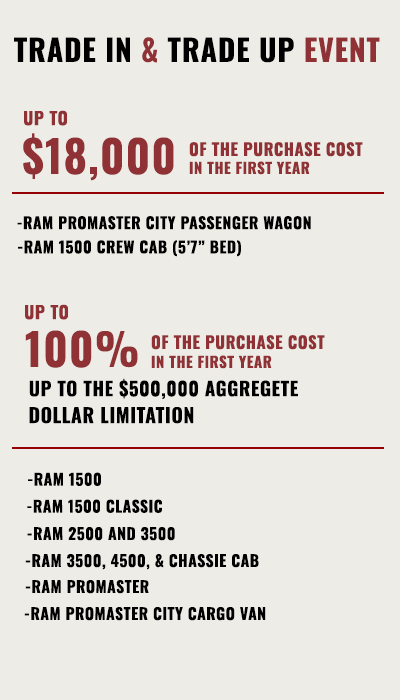

SECTION 179 FIRST YEAR EXPENSING

A Ram truck is generally considered Section 179 property for U.S. Federal Income Tax purposes. A taxpayer may elect to treat the cost of any Section 179 property as an expense and it's allowed as a deduction for the taxable year in which the property is placed in service. A qualifying business may expense up to $1,020,000 of Section 179 property during 2019.

The IRS has not yet released guidance concerning Section 179 and Bonus Depreciation as it relates to vehicles for this year (2019). The guidance will be published in the Internal Revenue Bulletin sometime after mid-year. *FCA will not release 2019 Vehicle Summary Bonus Depreciation and Section 179 Expensing until after this IRS release.

TAX SEASON INFORMATION

SECTION 179 & DEPRECIATION TABLES

Summary of 2019 Chrysler, Ram, Dodge, Jeep & Fiat Vehicles

Estimated Depreciation and Section 179 Expense Allowance

|

BusinessLink Manager

Tom Needham

(855) 996-5810

sddinternet@lhmauto.com